Managing a family budget can feel like herding cats. Just when you think you’ve got everything under control, unexpected expenses pop up and throw everything off. But don’t worry; with some smart strategies, you can keep your family’s finances in check and even save for those fun family vacations. Here are some tried-and-true budget tips that actually work for families just like yours.

Start with a Clear Picture

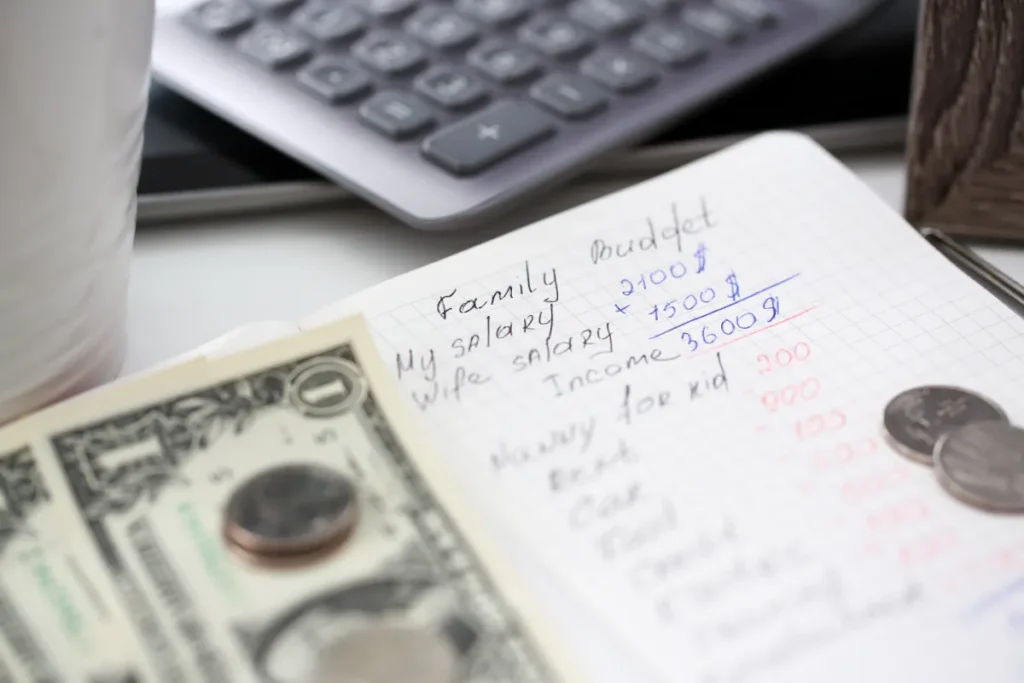

First things first, you need to know where your money is going. Track your spending for a month or two. You might be surprised by how much those little purchases add up. This will give you a clear picture of your financial habits and where you might need to make some changes.

Set Realistic Goals

What do you want to achieve with your budget? Maybe you want to save for a family holiday, pay off debt, or build an emergency fund. Set clear, achievable goals. When everyone knows what you’re working toward, it’s easier to make those day-to-day spending decisions.

Involve the Whole Family

Make budgeting a team effort. When everyone in the family understands the budget and why it’s important, they’re more likely to stick to it. Even young kids can learn about saving and making smart spending choices.

Use the Envelope System

This is an old-school but effective way to manage your budget. Put cash for different spending categories into separate envelopes, like groceries, entertainment, and eating out. When the envelope is empty, that’s it for the month. It’s a great way to visually see and control your spending.

Plan Your Meals

Impromptu takeouts and last-minute grocery runs can quickly blow your budget. Plan your meals for the week, make a shopping list, and stick to it. You’ll not only save money but also waste less food.

Cut Unnecessary Expenses

Take a close look at your monthly bills and subscriptions. Do you really watch all those cable channels? Is there a cheaper cell phone plan that would work for you? Cutting back on these recurring expenses can free up a lot of money in your budget.

Shop Smart

Look for sales, use coupons, and don’t be afraid to buy generic brands. Small savings on everyday items can add up to big savings over time. Also, consider buying in bulk for items you use a lot. Just make sure you have the space to store them!

Save Automatically

Make saving a no-brainer by setting up automatic transfers to your savings account. Treat your savings like a bill that has to be paid every month. Over time, you’ll build a nice nest egg without even thinking about it.

Have a Fun Fund

All work and no play can make budgeting feel like a chore. Set aside a little money each month for family fun. It could be for a movie night, a day out, or saving up for a bigger treat. This way, you can enjoy your time together without feeling guilty about breaking the budget.

Be Prepared for Unexpected Expenses

Life is full of surprises, and not all of them are pleasant. An emergency fund can be a lifesaver when unexpected expenses pop up. Aim to save enough to cover three to six months of living expenses. It might take time to build up, but it’s worth it for the peace of mind.

Review and Adjust Regularly

Your family’s needs and goals will change over time, so it’s important to review your budget regularly and make adjustments as needed. Maybe you’ve paid off a debt and can redirect that money to savings, or perhaps you need to tighten up in one area to cover increased costs in another.

By following these family budgeting tips, you can keep your finances on track and work toward your financial goals together. Remember, the key to successful budgeting is consistency and flexibility. Stick with it, and don’t be too hard on yourself if you slip up now and then. The important thing is to get back on track and keep moving forward.